Social Security And Workers Compensation Settlement

You have the right to social security retirement or disability benefits as well as workers compensation insurance which pays for the costs of an on the job injury as a wage earner.

Social security and workers compensation settlement. Workers compensation benefits are paid to a worker because of a job related injury or illness. Total workers compensation benefits cash and medical combined were less than social security disability benefits during the 1970s but grew steadily throughout the 1970s and surpassed social security disability benefits in the mid 1980s. Workers compensation and other public disability benefits however may reduce your social security benefits. Social security will look at the language of the worker s compensation settlement document to decide how much of the settlement is subject to offset.

However federal law requires the state s reverse offset law to have been in effect since before february 18 1981. The trend in workers compensation benefits as a share of covered wages follows a very different pattern. In some states workers compensation insurance companies will take a reverse offset one reason a workers comp insurer will request permission to access social security records for new claimants in this case social security will pay full disability. D oes a workers compensation settlement affect social security disability benefits.

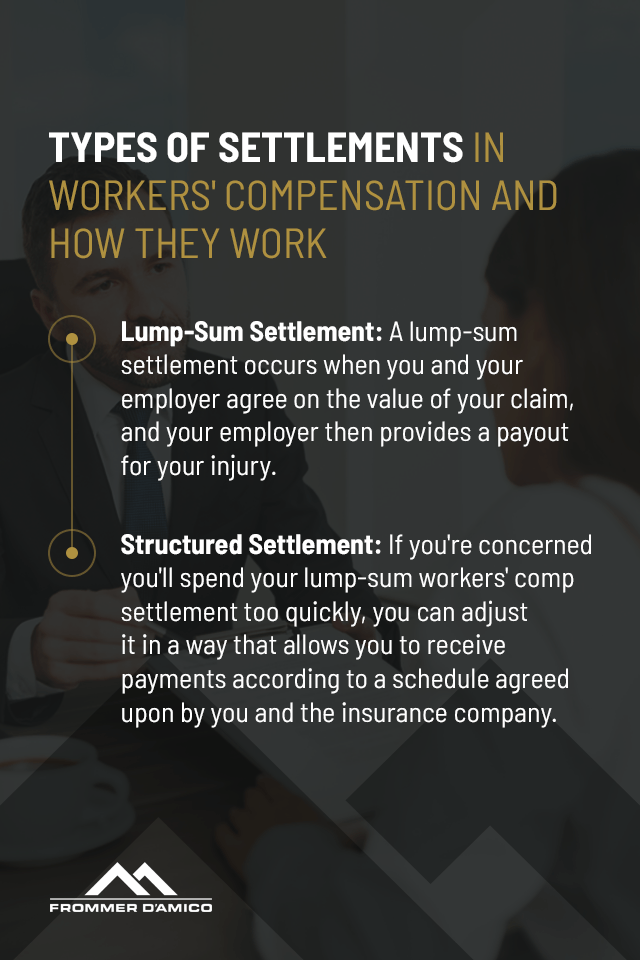

Ss disability insurance benefits may also be reduced if you receive public disability benefits which are disability benefits paid under a federal state or. Therefore the amended workers compensation lump sum settlement you submitted has no effect on your social security disability benefits. Your social security ss disability insurance benefits and family benefits based on your earnings record may be reduced to fully or partially offset your worker s compensation benefit. The social security retirement pension begins paying at 62 for early retirement while workers comp benefits have no age limit.

If you accept a lump sum settlement you must report it to your social security caseworker within 10 days. If the settlement amount pushes you over the income limit your ssi and medicaid benefits could be affected. They may be paid by federal or state workers compensation agencies. Unless the settlement involves an award of wages or self employment earnings or if it is a worker s compensation settlement and you are receiving disability benefits it will have no direct affect on your social security benefits.

However we consider the original settlement as final. Section 224 a b of the social security act 42 u s c.