Social Security Caregiver Credit Act Of 2017

It also supports medical training programs for caregivers.

Social security caregiver credit act of 2017. Social security caregiver credit act of 2017. The caregiver would have to document expenses and the credit would be 30 percent of the eligible expenses above 2 000. Social security caregiver credit act of 2015. This bill amends title ii old age survivors and disability insurance oasdi of the social security act for purposes of determining oasdi benefits to credit individuals who serve as caregivers of dependent relatives with deemed wages for up to five years of such service.

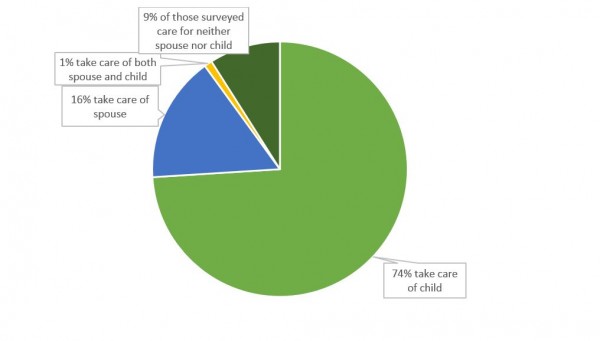

As the spouse or family member caring for a loved one who is seriously ill you can apply for social security benefits to help cover costs involved with being his or her caregiver. Eligibility depends on several factors such as financial need state of residence income and assets. Qualifying for social security as a caregiver. Senator chris murphy d ct has introduced the social security caregiver credit act of 2017 because social security benefits are based on earnings family caregivers currently face cuts in their own social security benefits when they have to reduce their hours of paid work or leave the work force entirely to provide ongoing support to a child or adult family member with a significant.

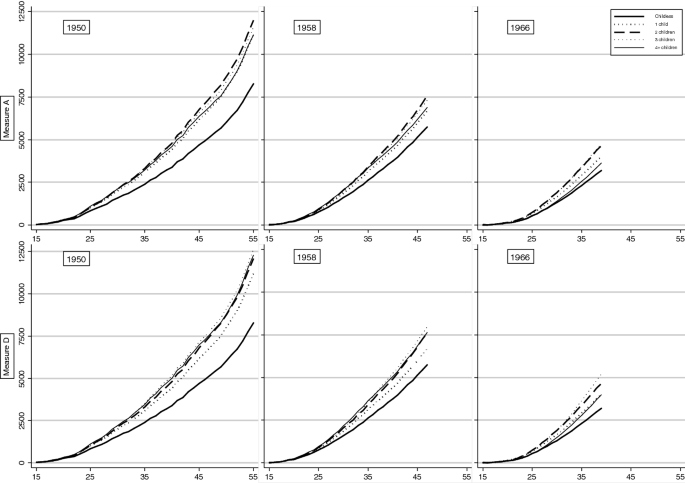

Social security caregiver credit act of 2017. In govtrack us a database of bills in the u s. This bill amends title ii old age survivors and disability insurance oasdi of the social security act for purposes of determining oasdi benefits to credit individuals who serve as caregivers of dependent relatives with deemed wages for up to five years of such service. The social security credits would be equal to the 50 of the average wages and self employment income for the time period when the caregiver provided assistance.

This bill amends title ii old age survivors and disability insurance oasdi of the social security act for purposes of determining oasdi benefits to credit individuals who serve as caregivers of dependent relatives with deemed wages for up to five years of such service. Among the bill s tax credit eligibility requirements a health care practitioner would have to certify that the loved one the caregiver is helping meets certain physical and cognitive needs. Titled the social security caregiver credit act of 2017 s 1255 the bill would credit individuals serving as caregivers of dependent relatives with deemed wages for up to five years of such service. Introduced in house 07 29 2015 to date there are 59 co sponsors in congress.

A bill to amend title ii of the social security act to credit individuals serving as caregivers of dependent relatives with deemed wages for up to five years of such service and to support state medical training programs for caregivers.