Social Security Retirement Benefits Ohio

Social security s spouse benefits are federally funded and administered by the u s.

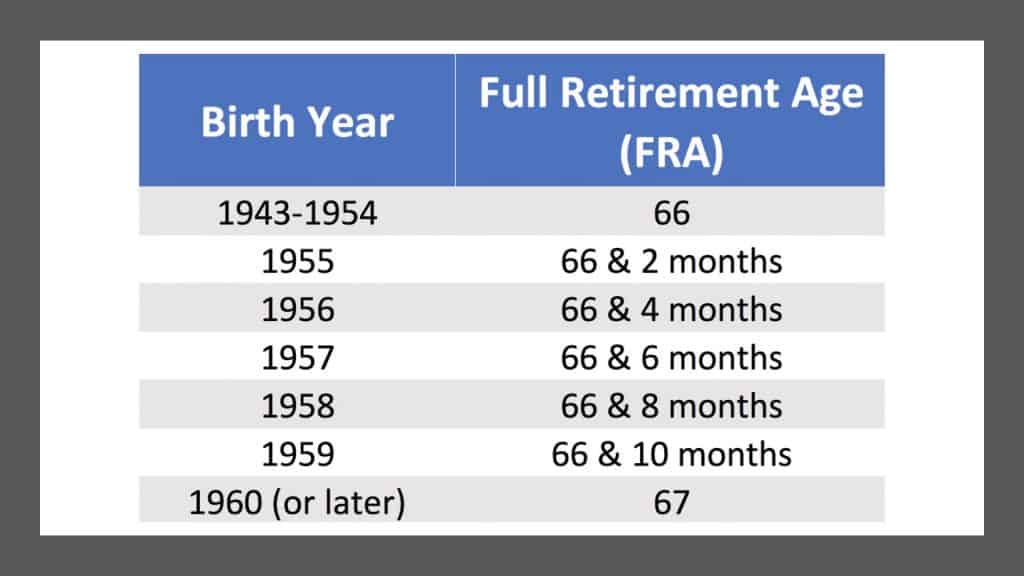

Social security retirement benefits ohio. Starting your social security retirement benefits is a major step on your retirement journey. Wep penalty declines with substantial earnings. En español full retirement age or fra is the age when you are entitled to 100 percent of your social security benefits which are determined by your lifetime earnings if you were born between 1943 and 1954 your full retirement age is 66. Laid off while receiving social security retirement benefits.

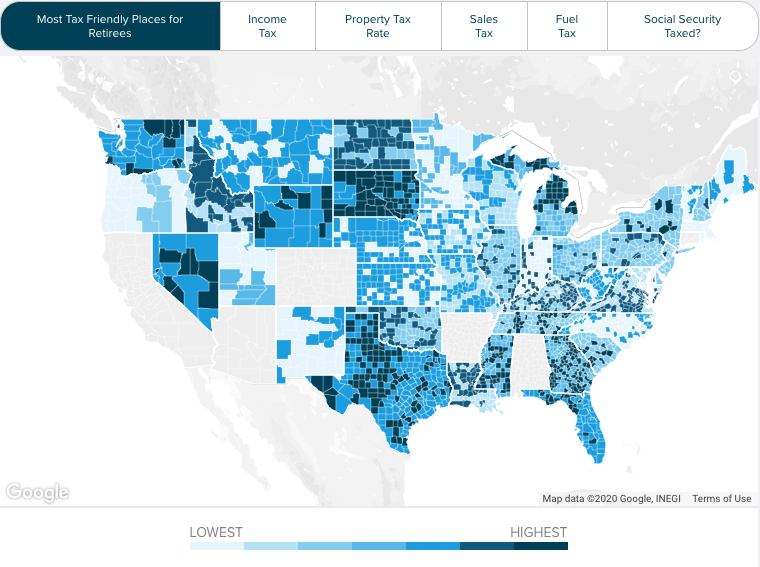

Both property and sales tax rates are slightly higher than the national average. This page will guide you through the process of applying for retirement benefits when you re ready to take that step. For those born between 1956 and 1959 it gradually increases and for those born in 1960 or later it. Social security administration ssa.

If you were born in 1955 it is 66 and 2 months. Receiving both benefits also won t affect either amount except for some recipients in minnesota see below. The same holds true for spousal or survivors benefits you claim on the earnings record of a retired or deceased worker. Collecting unemployment insurance does not prevent you from receiving social security retirement benefits or vice versa.

Social security retirement benefits are fully exempt from state income taxes in ohio. En español yes you can. The social security administration s website has an abundance of tips on the ins and outs of retirement benefits. These benefits are paid to the spouse of a worker who receives social security retirement or disability.

Apply for retirement benefits. It may also help to use a social security calculator to understand how your. Visit social security s retirement benefits section of the website to help better understand the program the application process and the online tools and resources available. For example if you worked as an engineer for 20 years before you began teaching you may be able to do enough part time work between now and.

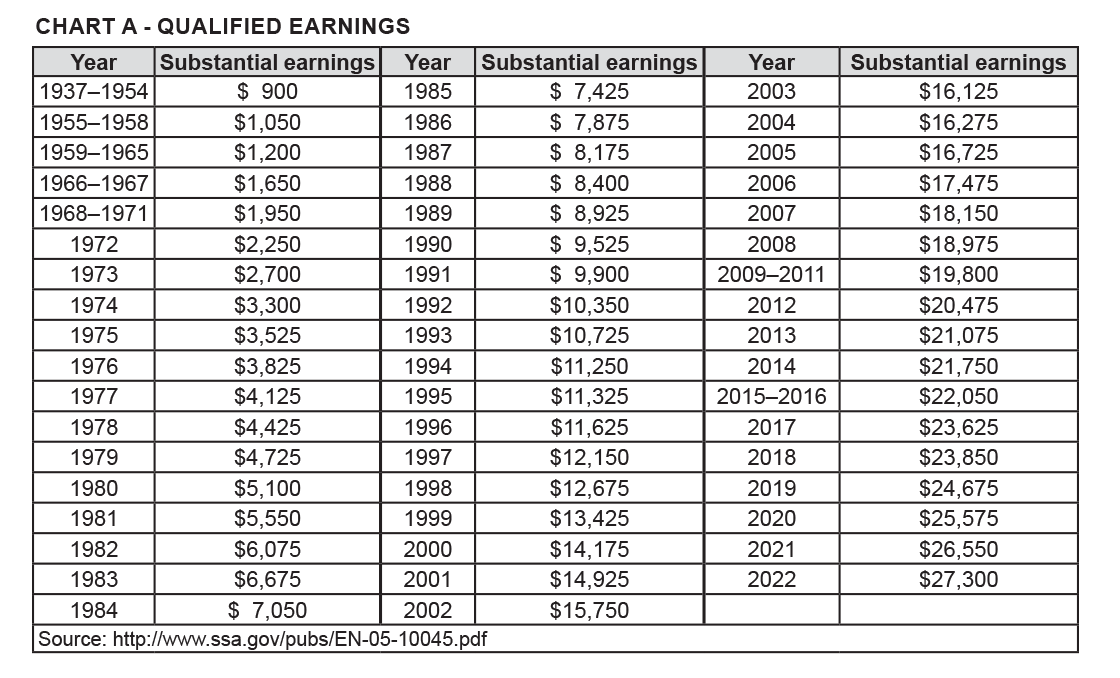

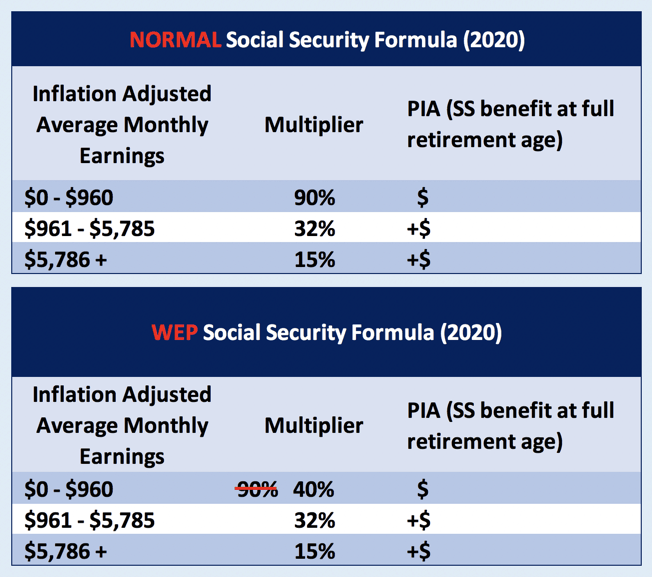

And money from unemployment also won t count as wages that affect the amount of your social security checks so there will be no reduction in your retirement benefits based on your jobless benefits. This phase out of the wep reduction offers a great planning opportunity if you have worked at a job where you paid social security tax.

/GettyImages-183271151-228e80ddbd674e5e919e236667c23983-1d9f636284ff402a828f971e694936f9.jpg)